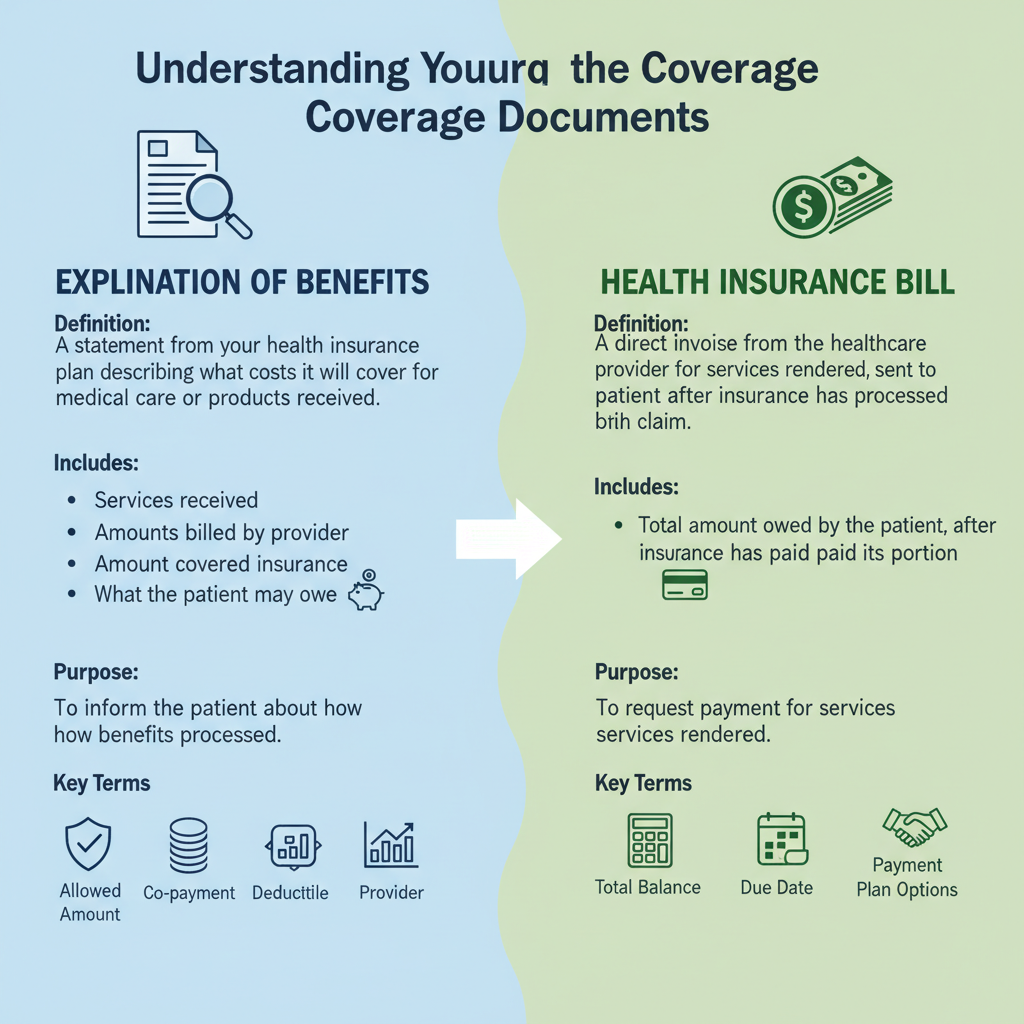

Understanding Explanation of Benefits vs an Actual Medical Bill

Healthcare paperwork can be confusing, especially when multiple documents arrive after a medical visit. One of the most common sources of confusion is the difference between an Explanation of Benefits (EOB) and an actual medical bill. Although they may look similar, they serve very different purposes—and knowing the difference can help you avoid unnecessary stress.

What Is an Explanation of Benefits (EOB)?

An Explanation of Benefits is *not* a bill. It’s a statement from your health insurance company that breaks down how your claim was processed. The EOB shows the services you received, what your provider charged, what your insurance covered, and what portion—if any—you may be responsible for.

Its purpose is to keep you informed and help you understand how your benefits are being applied.

What Information Does an EOB Include?

While formats vary, most EOBs include:

- The date of service and provider name

- A description of the services provided

- The amount billed by the provider

- The amount your insurance covered

- Any discounts or adjustments

- Your estimated responsibility (copay, coinsurance, or deductible)

Think of the EOB as a receipt of how your insurance processed the claim—not a request for payment.

You can access your EOBs online via your carrier's online portal.

What Is an Actual Medical Bill?

A medical bill comes directly from your doctor, hospital, or medical facility. This is the amount they are charging you after your insurance has reviewed the claim. The bill reflects what you truly owe based on your coverage and the insurer’s payment decisions.

If you owe anything, the bill will include the amount due and a due date.

How to Compare Your EOB and Bill

It’s always a good idea to compare your EOB with your medical bill to ensure everything matches correctly. The number listed as “patient responsibility” on the EOB should align with the amount billed to you by the provider.

If something doesn’t match, reach out to your insurance company or provider’s billing office—they can help clear up discrepancies.

Why Understanding the Difference Matters

Knowing how to read both documents can help you budget for medical expenses, avoid overpaying, and catch potential billing errors. Most importantly, it gives you confidence in navigating your healthcare costs. Remember—an Explanation of Benefits is an important tool for anyone who has health insurance!

If you ever have questions about EOBs, billing, or how your coverage applies, we’re here to help you feel informed and supported every step of the way.